INVESTMENT in 2024

This page summarizes monthly returns of the Hoperation Fund in 2024, with screenshots of its investment account. Each screenshot gives the initial and final balance of a month, with cash inflow (capital from contributors and fundraising events) and cash outflow (capital requested back by contributors, or capital withdrawn to donate charitable organizations).

2024 overview

In 2024, the Hoperation Fund's investment portfolio has achieved a return of 41.3%. Since its inception in June 2023, the portfolio has generated a cumulative return of 74.5%, significantly outpacing the major benchmarks such as the SPY (S&P 500 Index ETF) and the QQQ (Nasdaq 100 Index ETF).

This consistent market outperformance is a testament to our long-term investment strategies and risk control though AI algorithms.

2024.1

In January, our investment had a return of 4.56%. The Hoperation Fund's balance increased from $9343.50 to $9769.23.

2024.2

In February, our investment had a return of 8.10%. The Hoperation Fund's balance increased from $99769.23 to $10560.82.

2024.3

In March, our investment had a return of 3.15%. The Hoperation Fund's balance increased from $10560.82 to $10893.12.

2024.4

In April, our investment had a return of -1.33%. At the beginning of April, $728 was withdrawn to donate our selected charitable organizations. Also, at the beginning of this month, the Fund added $245 received from a contributor, and $1215 from fundraising activity. The Hoperation Fund's balance reached to $11470.94.

2024.5

In May, our investment had a return of 8.23%. The Hoperation Fund's balance increased from $11470.94 to $12414.93.

2024.6

In June, our investment had a return of 6.35%. The Hoperation Fund's balance reached to $14478.99. The Fund liquidated POWL and USD, and opened a new position MAGS.

2024.7

In July, Hoperation Fund had a return of -2.46%, bringing the Fund's balance to $14,122.49. In this month, the Fund liquidated its positions in MAGS, MA, and LVMUY, while initiating new positions in PHM, representing 1.5% of the capital, and WES, accounting for 2.0% of the capital. For a detailed explanation of the rationale behind the WES investment, please watch the Monthly Meeting video.

2024.8

In August, our portfolio achieved a return of 2.11%, bringing the total balance to $14,828.86. We also initiated a new position in MSCI, allocating approximately 4.5% of our capital as a long-term investment. For a detailed explanation of the rationale behind the MSCI investment, please watch the Monthly Meeting video.

2024.9

In September, Hoperation Fund had a return of 2.74%, bringing the Fund's balance to $17618.48. In this month, the Fund liquidated its positions in RSP, while initiated new positions in FXI, ITB, and IYT, and increased shares of existing positions.

At the beginning of this month, the Fund refunded $50 to one contributor, received donation $200 from a contributor, and membership fee $2170 from over 50 members.

2024.10

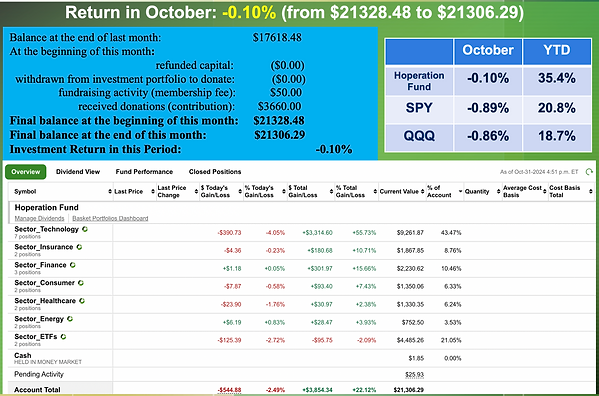

At the beginning of the month, the portfolio received a cash inflow of $3,710, comprising $50 in membership fees and $3,660 in donations from contributors. This brought the starting balance to $21,328.48. Over the month, the portfolio returned -0.10%. During this period, the fund sold FXI, ITB, and IYT, increased holdings in MSCI, COST, MSFT, and AMZN, and initiated a new position in QLD.

2024.11

In November, Hoperation Fund had a return of 6.32%, bringing the Fund's balance to $23225.97. In this month, the Fund liquidated its positions in NVO, and increased shares of existing positions in technology.

At the beginning of this month, the Fund received donation $230, and membership fee $310.

2024.12

In December, the portfolio recorded an investment return of -1.83%. During the month, minor adjustments were made, with some positions being slightly reduced and others incrementally increased. By the end of December, the cash allocation stood at 16%.